You would have to be living under a rock or in an area that is completely off grid to not be somewhat aware that real estate prices have been fluctuating and increasing significantly in many areas over the past couple of years. If you have not purchased or refinanced recently, your homes value might have changed from where you thought it was just 12 -18 months ago. Knowing the value of your home can be important for many reasons of which, here are a few:

Financial Planning

The value of your home is a significant component of your overall net worth. Your home is likely one of your most significant assets. Knowing its value allows you to calculate your net worth accurately. Understanding its value helps you make informed decisions about your financial planning, such as determining your assets, calculating your equity, or evaluating your borrowing capacity.

Selling or Renting

If you're considering selling or renting out your property, knowing its value is crucial. It allows you to set a competitive price that aligns with the market, ensuring you don't undervalue or overprice your home.

Refinancing or Home Equity Loans

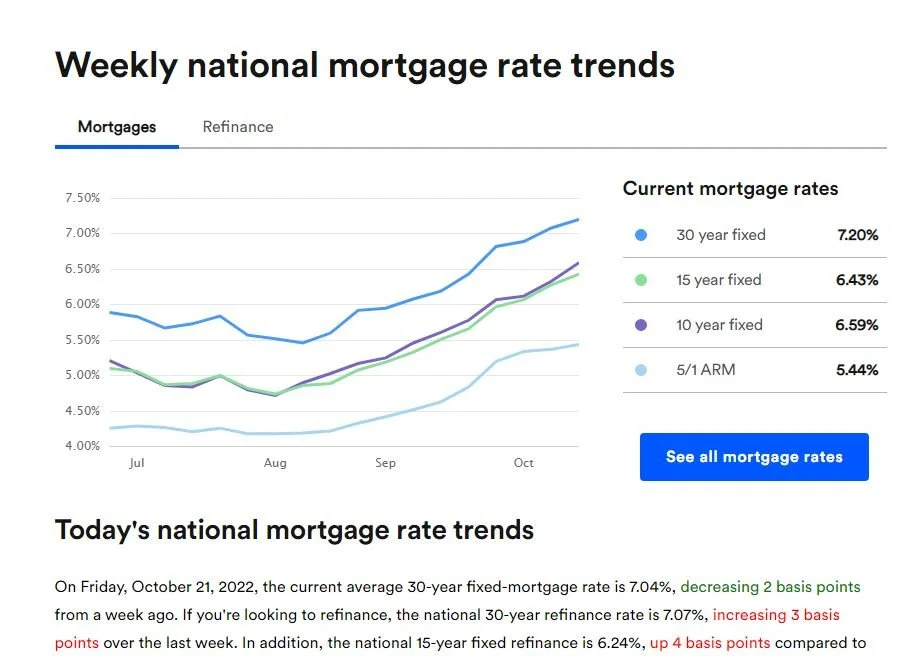

When refinancing your mortgage or applying for a home equity loan, the value of your home plays a vital role in determining the amount you can borrow. Lenders assess the loan-to-value ratio, which compares the loan amount to the home's appraised value, to determine eligibility and interest rates.

Property Taxes

The value of your home often influences property tax assessments. Local tax authorities use property values to calculate the amount of tax you owe. Knowing your home's value helps you ensure that you're being taxed fairly and can plan for potential increases.

Insurance Coverage

Understanding the value of your home is essential for obtaining the appropriate insurance coverage. If your home is underinsured, you may not receive sufficient compensation in the event of damage or loss. Conversely, overinsuring your home means paying more in premiums than necessary.

Investment Decisions

If you're considering real estate as an investment, knowing the value of your home can help you assess its potential return on investment, evaluate rental income potential, or make informed decisions about buying additional properties.

It is important to note that home values can fluctuate over time due to various factors such as market conditions, location, renovations, or changes in the neighborhood. Therefore, regularly monitoring and assessing your home's value is important for staying informed. If you would like to check out more information regarding the importance of knowing your homes value, check out the following articles: