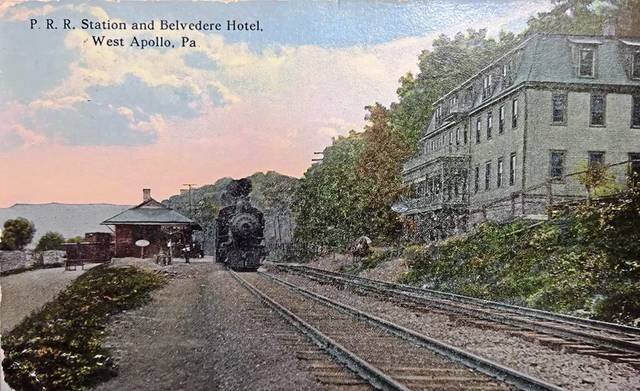

Some of our readers from areas where a residential lot can sell for $100,000 will find this question unthinkable. Even in those areas, they may know of “brownfields,” or areas that have been contaminated. Sadly, from my desk, I’m within miles of two such sites, but that isn’t the subject of our topic today. Today I want to introduce you to the historic building in Oklahoma Borough just outside of Apollo Pennsylvania, the Belvedere Hotel (on the left in the postcard above).

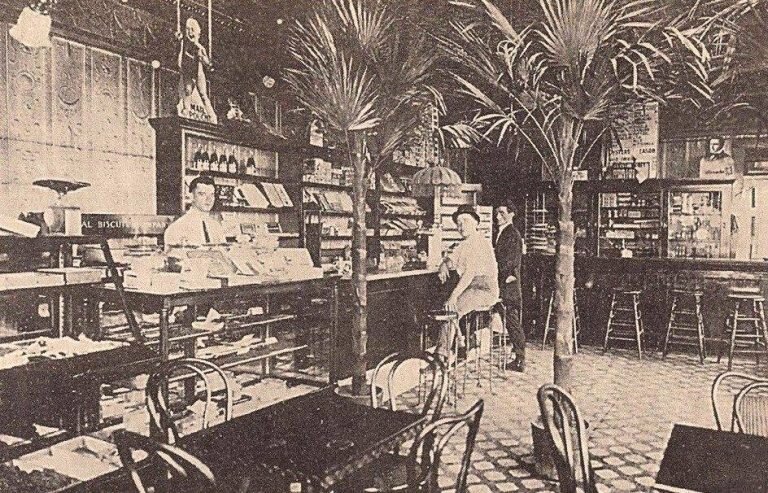

Built in 1905, the Belvedere sat directly across from the West Apollo rail stop. For the last train of the day arriving at 12:45 am, this served as a wonderful service for those who didn’t want to make any more progress at night. Featuring a candy shop and ice cream parlor on the first floor, these were eventually converted over to a bar. The building eventually got its local nickname, “The Tin Hut”, for its beautiful tin ceilings.

However, as the rail stop was removed and the road widened to accommodate the increase in traffic, which subsequently took away the hotel’s parking, business became far more difficult. Despite plans for revitalizing the spot after the purchase in 1982 for $24,000, the hotel was condemned in 2017 as unsafe.

In 2018 bids were secured for the demolition of the structure, however, these quotes ranged from $200,000 to $500,000 (123-300% of the entire annual budget of the borough this property is in). However, an arsonist seems to have “reduced this cost***” in late 2019 to $48,700. It was in 2019 that the Borough of Oklahoma obtained ownership of this property.

So, how much is this 2.5-acre parcel worth? The owner sold the property to the borough for $1, after the borough and the county spent $48,700.

Let’s take a deeper look though:

The property is zoned commercial in an area where there is not a high demand for commercial property

The property is basically a cliff- within its width of approximately 300 feet, it drops nearly 200 feet

The property is located on a busy road at a busy intersection with no parking

The property is located directly across from a railroad crossing- you can see the guard rails that block traffic at the edge of the building in the one picture provided

The borough has terraced the land and planted grass, posting no trespassing signs… not for sale signs.

You would think that the borough would want to make some of their money back if they could, but in my opinion, I don’t think they can. In short, there is no market in the area for cliffs. The land is “surplus” with no other use than assemblage with an adjoining property. However, who would pay money to own a cliff and the tax and insurance liability that goes with it?

So if we assume that the land, as vacant is in fact worthless. How much was it worth after the fire? What about before the fire?

Sometimes taking a look at the edges of the spectrum can inform our opinions. Is land always worth something? No. Do structures always add value to a property? No. Sometimes an extreme over improvement (as opposed to the under improvement that we see here) could make a property unmarketable (imagine a multi-billion dollar home in an area of shacks, who would buy it?) Its also an important reminder that while “cost does not equal value,” it can be a useful starting point to extract data from.

***There are serious health and safety questions that have yet to be answered publicly. It was reported that the high cost was in part due to the asbestos in the building. The demolition after the fire was not contained (though, how that would be possible is a hard question), so, where did the asbestos go and how did that affect the surrounding environment?

While the author is an appraiser, this should not be construed as an appraisal. The author uses their experience in the field of property valuation to glean real estate principles for educational purposes.