The year 2022 was a year of historically low inventory and high demand, unlike anything Greensburg has seen in recent history. Interest rates have been a major player in the market this year and definitely caused some of the historic gains to cool off towards the last quarter of the year. As rates rose, activity slowed- at least to a certain extent. As you look through this report, you will notice that the rise in mortgage rates corresponds to other market data events.

The annual median home sales price for all residential properties in Greensburg rose from $149,950 in 2021 to $173,450 in 2022 which is a 15.7% increase. Compare that to the year 2020 when the median sale price was $135,000 and the increase was at 11.1%. In looking to this coming year, it is safe to say that these increases will cool down. To what degree will depend on mortgage interest rates, inflation, demand and market saturation.

The general trend in the median sale price over the past year has been increasing with the peaks in those increases showing up during the summer months.

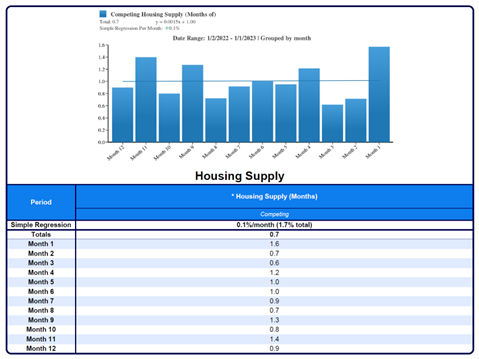

The supply has been historically very low in 2022. The supply appears to have had a sharp increase towards the end of the year which is counter intuitive to cyclical seasonal historical data.

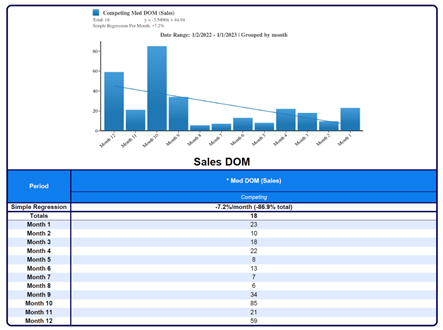

The marketing times (expressed in DOM- days on market) has also been extremely low. However, in the past few months, this has been rising due to a cooling in the market most likely attributed to seasonal cyclical events during winter months and compounded by the rising mortgage rates.

As is expected, the quantity of sales decreased in the last quarter of the year.

One point of data I was surprised to see pertains to the actual number of transactions year over year for the last 3 years. The years 2020 and 2021 had a high number of transactions with 2022 showing a slight drop off. This is conversely affected by the fact that with fewer transactions, there was a higher median sale price.

The current number of active listings is also decreasing. We will have to wait a few months to see if this starts to increase when the market typically experiences seasonal cyclical events around March or April when sellers like to place their properties on the market.

Not only as demonstrated in the previous chart which showed the number of actives decreasing, the median list price is also decreasing. This could be significant to keep in mind. As the marketing times increase and the list prices decrease, this could have a direct impact on the median sale price going forward. Only time will tell how all of this will affect 2023 sales.