Next up in our review of the URAR 1004 (found here: https://bit.ly/2IkOwqn)

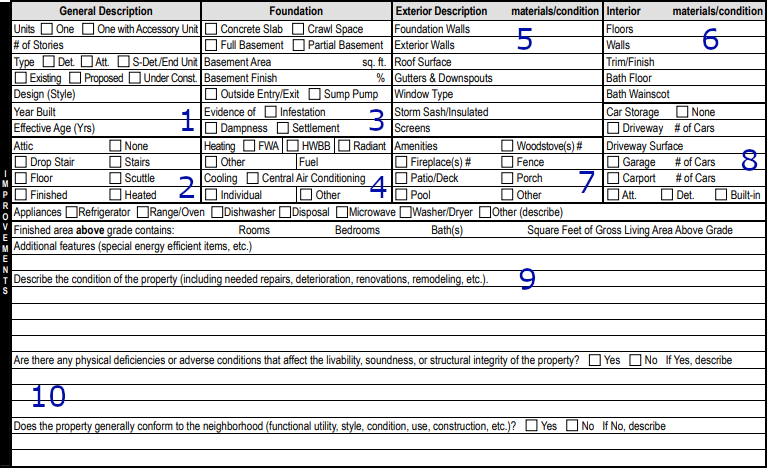

Gross Living Area is the heated, finished, living area that is totally above the grade of the soil.

Gross living area is NOT unfinished areas, unheated areas such as enclosed porch, or areas that have ANY portion below the grade of the soil. Heated garages are not living area. Heated pool houses are not living area. Unheated half finished attics are not living area and basements are not part of the GLA of the home. These are the Fannie Mae standards that appraisers must follow when performing appraisals that will be sold on the secondary market.

This is why the finished areas are divided into the “Above Grade” and “Basement” levels in the grid above. Many counties may tax you as though the finished basement level is the same as the above grade, however, Fannie Mae recognizes that the actual real estate market does not.

Functional Utility is the ability of the home to provide for its intended purpose. Examples of problems of functional utility are:

Captive bedrooms - having to walk through someone’s bedroom in the middle of the night in order to get to your own bedroom is not the typical intended purpose of a bedroom.

Having the only full bathroom be in the unfinished basement is not what the market expects from a bathroom.

Having a half bathroom in the back of the home and another half in the front of the home, with no full bathroom, is not typical.

Having the home’s water well be in a hole in the living room floor… is not typical.

Having a 3000 sf 1 bedroom home is not a typical function of a home

Having the holding tank of the septic tank be within the walls of the home, is not typical.

Town and Country has appraised ALL of the above.

Functional utility is often those items that make you say “Wow!” or “Why?!” An appraisers job is to recognize those items and collect data to determine the impact on appeal because of those items. Sometimes these items can be cured (the cost of fixing the issue is less than the value increase) and sometimes they are incurable (the cost of fixing the issue is more than the value increase).