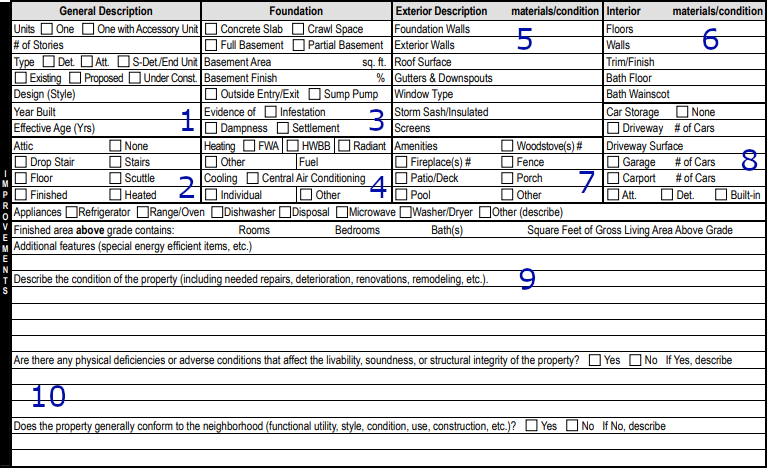

The improvements to the property include all of the structures added to the site. This section breaks the dwelling into a variety of sections for recording:

This describes the units construction and style. Effective Age is number given to the home based on the overall condition of the dwelling.

Simply describes the attic space and what access or finish is located there.

Gives data on areas of the home that are located below the grade of the soil. This includes finished and unfinished portions, and any of the common deficiencies found there. Its important to note that for lending purposes, the finished area below the grade of the soil is treated differently than what is located above grade.

Describes the heating and cooling of the home.

Describes the outer construction of the home and the condition of those elements.

Describes the inner construction of the home and the condition of those elements.

Gives a record of any amenities that may/may not be found in typical homes.

Describes the car storage on the site.

This portion of the form is rather self explanatory, its a simple reporting of the facts with little analysis. Sections 9 and 10 represent a more subjective portion of process.

Section 9: Asks the appraiser to describe the home’s improvements/special features/deterioration. This section is supplemented by the photograph addendum. The deficiencies we are asked to look for fall into 3 categories:

Safety - any deficiencies that could pose a safety concern to the occupant. These could include, a) lack of handrail/railings, b) exposed/unsafe wiring, c) tripping hazards in carpet, d) missing extension pipes on pressure relief valves on water heaters, etc.

Structural Integrity - we are asked to look for elements of the home’s construction that could threaten the improvement’s long term existence. Things like a) shifting foundations, b) leaking roofs, etc. The appraiser must determine that the home has a minimum 30 years remaining economic life.

Security - this refers to the subject’s ability to secure a loan. When it comes to loans that are backed by or underwritten for FHA/VA/USDA, additional regulations apply. For example, FHA/VA/USDA require that in homes built prior to 1978, ALL chipping and peeling paint be removed and painted on the basis of the possible existence of lead based paint. Standing water in basements automatically trigger the appraiser to require an inspection by a qualified professional. If this isn’t done, those loans can not be written for the subject.

These issues must be corrected BEFORE a loan can be made on the subject property.

Section 10 asks two questions:

Do any deficiencies rise to the level of affecting the livability, soundness or structural integrity of the home? This goes along with the above.

Does the property conform to the market area? If the market expects…

4 bedroom 2,000 sq ft homes and the subject is a 1 bedroom 700 sq ft home - it doesn’t conform

Homes with a roof in proper condition and the subject has an “unplanned skylight” - does not conform

Ranch homes on 3 acres and the subject is a town house with shared party wall and no yard - does not conform.

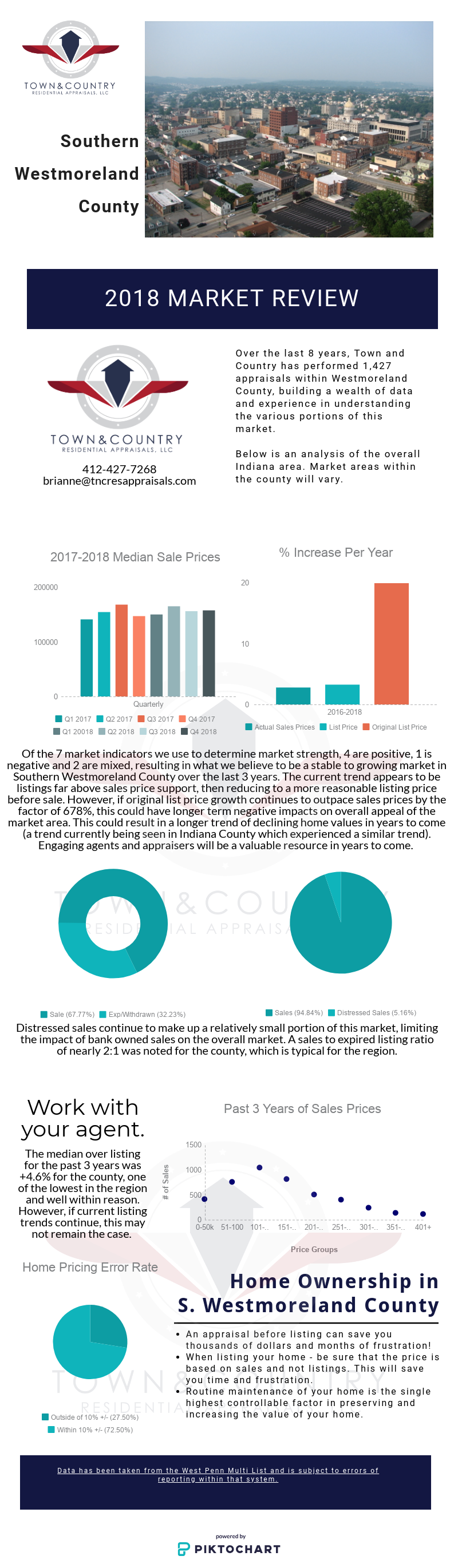

Market conformance is a subjective analysis based on data from the area and observations by the appraiser. The information reported to the lender is used to make determinations on whether to write a loan or not. The appraiser doesn’t have the final word - they merely observe and report the information available in all of the above areas.